What Cloud Marketplaces Do and Don’t Do

Not long ago, we observed here in our blog that the critical insights that drive business value come from data that is both (1) fast and (2) reliable.

There’s an old saying: “What gets measured gets managed.” This sentiment represents the foundation of ESG best practices. The best practices are challenging to achieve, however, without effective external-data integration.

Recently, Strategic Finance Magazine interviewed our Chief Revenue Officer, Patrick Ball, on this topic for an article on ESG data management. Here are some of the highlights from that interview:

Data governance solves for greenwashing and greenwishing

Greenwashing—overstating ESG practices and successes—does happen. But even when organizations have their hearts in the right place and aren’t greenwashing their ESG commitments, they often may be committing greenwishing—that is, setting an ambitious ESG goal (e.g., “carbon-neutral by 2030”) without any clear roadmap in place to achieve it.

The problem lies in a lack of data—or, at least, easy access to usable data. The G in ESG stands for Governance; this includes data governance. At the outset of any ESG initiative, organizations should start by putting strong data-governance processes in place. From there, using data, they can assess the following:

To do any and all of this, an organization needs to be able to easily access—and easily manage—analytics-ready ESG data (much of which will come from third-party sources).

Governance means direct involvement from the C-suite

Even beyond the CEO and the board, senior leadership must drive ESG data-governance efforts from the top down.

ESG strategy relies heavily on data. As such, leaders such as CTOs (chief technology officers), CSOs (chief security officers), and CIOs (chief information officers) should be involved in establishing an ESG data-governance framework. Additionally, larger companies may have more-specialized roles with their own crucial role to play in ESG efforts, such as a Chief Data Officer or a Chief Sustainability Officer.

This being said, CFOs represent the perfect advocates for ESG because of the critical role they play in organizational reporting. Given CFOs’ focus on the long-term financial sustainability of an organization, they can document and report how ESG efforts will impact an organization’s risk—a factor in capital access.

CFOs can also help stakeholders understand the value creation and cost savings from ESG efforts.

ESG matters to the bottom line

Reputational risk is real, and it’s not just anecdote-driven speculation to hype up ESG. Research demonstrates that companies have a lot to gain—or lose—when it comes to ESG.

External-data integration matters to ESG

ESG is hard, and external data is hard. But the more data organizations integrate, the more they can monitor and manage processes in real-time to avoid spiraling costs on the path to ambitious ESG targets.

The volume of ESG data available can be overwhelming. A good place to start is by integrating core datasets from well-established ESG data providers. Organizations can then identify what gaps they need to fill with more niche datasets tailored to company needs.

Digital transformation and emerging tech make ESG-data integration easier and faster

Cloud migration and advancements in data-integration technology have made it easier for organizations to ingest and analyze a high volume of ESG data more efficiently. Qualitative ESG data—such as text in a Task Force on Climate-Related Financial Disclosures (TCFD) report—is especially cumbersome to analyze.

Moreover, automation is enabling enterprises to extract and interpret this data with greater speed and accuracy. In turn, more analytics-ready data means more insights to assess gaps in ESG efforts and fuel new strategies.

The result is what we call data-integration maturity.

ESG-data maturity drives scalability

Across industries, organizations are taking a more data-driven approach to ESG with improved measurement, analysis, and disclosure of ESG metrics.

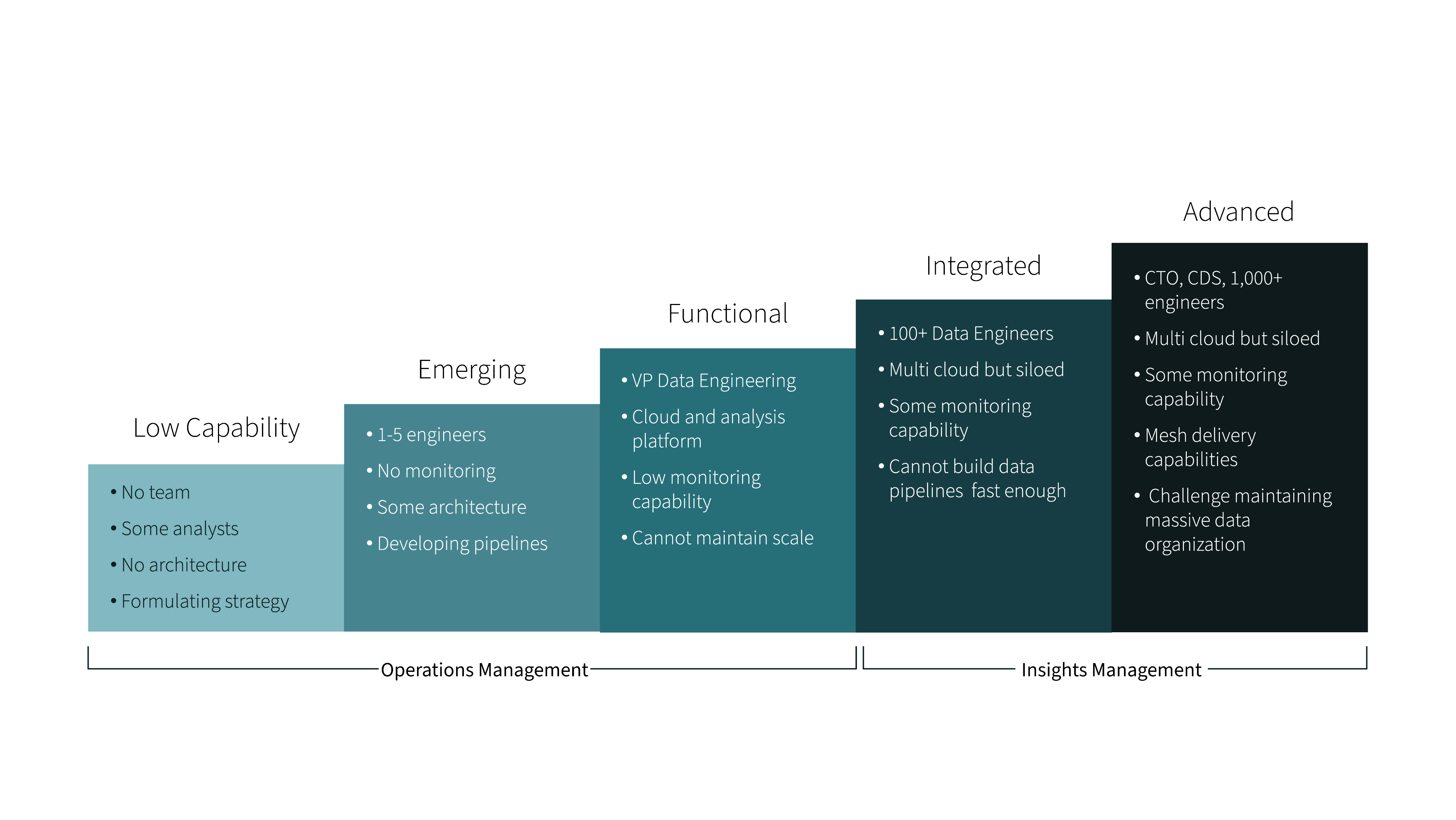

We like to think of this growth in terms of a data-integration maturity curve.

In companies with the most advanced level of data maturity, leadership is brought into ESG-data integration, and the organization can scale its data operations while balancing costs with ROI. These organizations have reached a point where ESG data is embedded in their operations. As a result, they are able to provide stakeholders with transparent, evidence-based decisions around ESG.

At the opposite end of the spectrum are organizations with low data-integration capabilities. These organizations have an ESG vision on paper—but no data team or architecture to implement data integration. For low-maturity organizations, the quickest way to scale ESG DataOps is often to outsource to a vendor.

To learn more about Crux’s data-integration offerings, download our white paper on ESG data challenges here—or, if you have questions, reach out to us here.

Not long ago, we observed here in our blog that the critical insights that drive business value come from data that is both (1) fast and (2) reliable.

This past year has been exciting, representing the dawning of a new age for artificial intelligence (AI) and machine learning (ML)—with large...

How do you get white-glove customer service from a major data supplier?